Today, Americans are perhaps more uncertain about their financial future than ever before. And yet it is also likely no other generation has managed more material assets with less training. As one Christian financial firm bemoans, "In a single generation today, an individual can go from near poverty to an estate of millions of dollars. Unfortunately, the succeeding generation can just as quickly lose it all. We seem to be a people of extremes."1

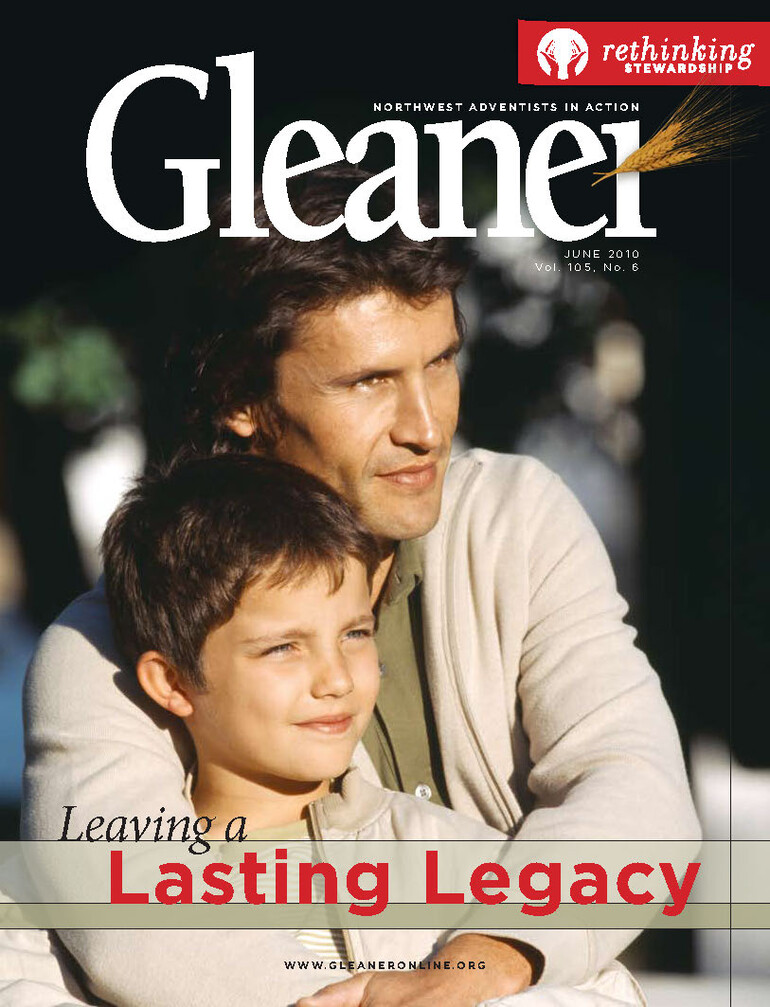

Many Adventist Christians have taken Paul's advice to heart: "If anyone does not provide for his own, and especially for those of his household, he has denied the faith, and is worse than an unbeliever" (I Timothy 5:8). But, as any good parent knows, just passing money along can become a curse, not a blessing.

Larry Burkett, who founded what later became Crown Financial Ministries, once asked a man who had accumulated a sizeable estate what he was planning to do with it. "I'll leave it to my children, I guess," he replied. "Why not give it all to them now?" Larry asked. "Well, they'd just lose it all," the man said. When Larry retorted they might do the same after the man had died, he replied, "Well, I'll be gone then, so who cares?"2

God cares. And, as his management team, so should we. Good stewardship, whether we're talking about the environment or a financial roadmap, leaves a tangible legacy that grows rather than diminishes our vision for the future.

That legacy is why Ben and Brittany decided to make a change in their lifestyle. Proud 30-something parents of two grade-school children, they wanted to fit in with their active friends. Before long they had a boat, several ATVs, polished hardwood floors and a new TV. The problem was a mountain of debt was beginning to squeeze the life out of them. So they got smart and took a simple, yet difficult, first step — they sat down and prayerfully wrote out what they wanted their future and the future of their children to look like.

Brittany says, "There was no way our current lifestyle was going to get us anywhere close to where we wanted to be." Ben saw it too. "The legacy we were going to leave our children was, debt, debt, debt. We decided we really wanted them to grow up to be givers, not takers."

Ben and Brittany have begun this lifelong change at a relatively young age. They're fortunate. Many come to this realization after decades of self-focused living. The earlier you begin a life of stewardship, the greater your options.

Are you single? Guard against becoming inward-focused. This is an ideal time to develop your life and legacy plan. And don't just leave it in the "good intentions folder." Find and use practical opportunities to apply your philosophy of stewardship at church, in the workplace or within the community.

Are you out of work? Don't despair. You're at the spot where so many have turned the corner toward greater success. While you may need to receive for a time until you get back on your feet, you will gain empathy and understanding as stepping stones to a life of generosity.

Think your assets are too small to make a difference? Consider the example Jesus gave of the man with just one talent. Because he considered it unworthy of investing, he lost even what little he had. If faith as small as a mustard seed can move mountains, if five loaves and two fish can feed thousands, think of what your one talent can do if placed in the right hands.

As Gary Dodge, North Pacific Union Conference planned giving and trust services director, puts it, "The miracle in God's plan is this — the more we share, the more we have." It's a thought directly from 2 Corinthians 9:6.

1. Crown Financial Ministries, "The Issue of Inheritance," www.crown.org/Library/ViewArticle.aspx?ArticleId=539.

2. Ibid.